Last updated on March 6th, 2025 at 11:36 pm

The solar tax credit, a cornerstone of renewable energy incentives, holds immense significance in driving the adoption of solar power solutions. By providing financial incentives for the installation of solar energy systems, the tax credit effectively reduces the upfront costs associated with adopting solar power technologies.

This, in turn, makes solar energy more accessible and affordable for homeowners, businesses, and organizations, encouraging widespread adoption and investment in clean energy solutions. In this article, we have given a comprehensive overview of the solar tax credit, understanding its importance, eligibility criteria, claiming process, and its potential benefits. Lets dive in!

2. The tax credit is reserved for newly installed solar panels, emphasizing the importance of investing in fresh solar technology.

3. Lease arrangements for solar panels are not eligible for the tax credit, ensuring that only direct purchases or financed acquisitions are rewarded.

4. Tax credit covers panels, hardware, inverters, battery storage, and associated labor costs, providing comprehensive financial support.

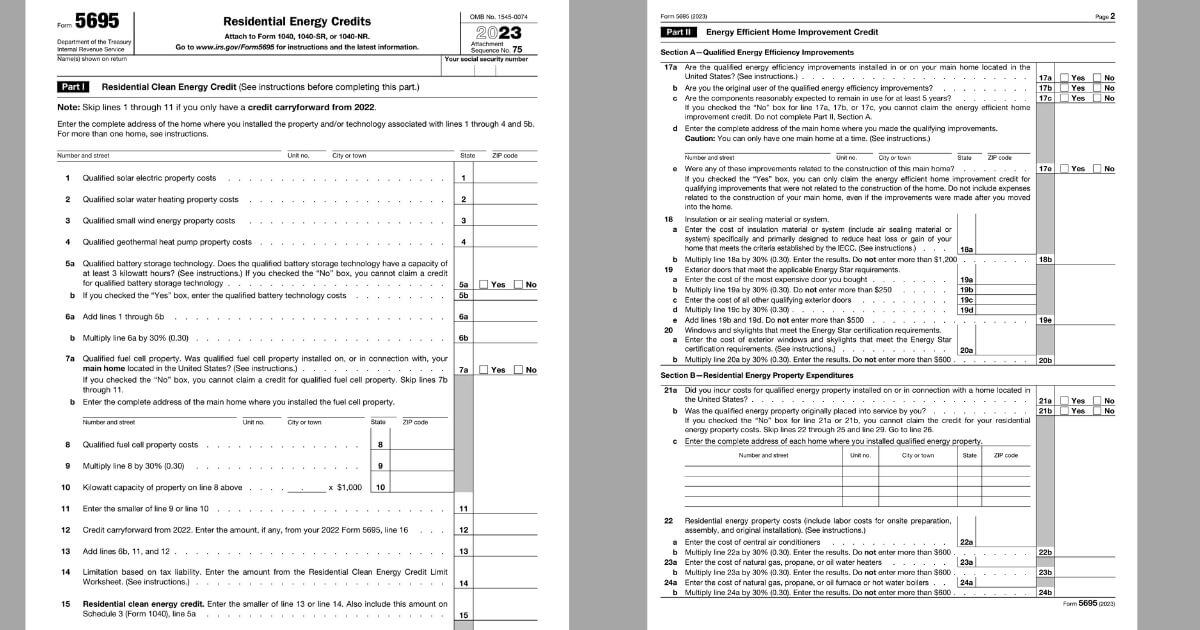

5.To access the tax credit, individuals must accurately report their qualified expenditures on IRS Form 5695, ensuring compliance with IRS regulations.

What exactly is a tax credit?

A tax credit is a type of financial incentive offered by governments to encourage certain behaviors or activities. Unlike deductions, which reduce the amount of taxable income, tax credits directly reduce the amount of taxes owed.

This means that if you qualify for a tax credit, you can subtract the full amount of the credit from the total amount of tax you owe to the government.

Tax credits can be either refundable or non-refundable. Refundable tax credits are beneficial because if the amount of the credit exceeds the amount of tax owed, the taxpayer can receive the excess as a refund. Non-refundable tax credits, on the other hand, can only reduce the tax owed to zero; any excess credit cannot be refunded.

Concept of the federal solar tax credit

The federal solar tax credit, known as the Investment Tax Credit (ITC), serves as a government incentive aimed at promoting the adoption of solar energy systems. Both residential and commercial properties are eligible for this tax credit, encouraging homeowners, businesses, and organizations to invest in solar energy systems.

Between 2020 and 2021, solar photovoltaic (PV) systems qualified for a 26% tax credit. However, in August 2022, Congress approved an extension of the ITC, boosting the credit to 30% for installations completed from 2022 to 2032.

Notably, systems installed on or prior to December 31, 2019, also qualified for the higher 30% tax credit. The percentage of the ITC is slated to decline over time, dipping to 26% for systems installed in 2033 and further to 22% for those installed in 2034. After 2034, the tax credit is poised to expire unless Congress renews it.

The federal solar tax credit allows eligible taxpayers to claim a percentage of the cost of installing solar energy systems as a credit against their federal income taxes.

Qualified expenditures typically cover the purchase and installation costs of solar panels, solar water heaters, and other solar energy systems for residential and commercial properties. However, to qualify for the tax credit, these expenditures must meet specific requirements set by the Internal Revenue Service (IRS).

Do I meet the requirements to claim the federal solar tax credit?

Condition of Solar Panels

The solar panels must either be brand new at the time of installation or constitute the original installation on the property. This criterion ensures that only newly installed or first-time solar panel systems are eligible for the tax credit. Panels that have been previously installed and then reinstalled or reused may not qualify.

Installation Deadline

To qualify for the tax credit, the solar panel system must be installed and operational before the end of 2034. This means that the installation process, including mounting the panels and connecting them to the electrical system, must be completed by this deadline.

Location Requirement

The property where the solar panel system is installed must be located within the geographical boundaries of the United States. This requirement ensures that only installations within the jurisdiction of the United States are eligible for the tax credit.

Payment Method

Eligible expenses for claiming the tax credit include the purchase of solar panel systems using either cash or financing. Cash purchases involve paying the full cost of the system upfront, while financing options may include loans or other forms of credit. It’s important to note that leasing arrangements, where the solar panels are rented rather than owned, do not qualify for the tax credit.

What types of expenses are considered for the federal solar tax credit?

The federal solar tax credit considers various types of expenses when determining eligibility. These include:

Cost of Solar Panels: The expense of purchasing solar panels, which convert sunlight into electricity, is eligible for the tax credit. This includes the cost of the panels themselves as well as any necessary mounting equipment.

Installation Costs: Expenses associated with the installation of the solar energy system are also considered. This includes the labor costs for professional installation, wiring, and any necessary permits or inspections.

Solar Inverters: The cost of solar inverters, which convert the direct current (DC) electricity produced by the solar panels into alternating current (AC) electricity used in homes and businesses, is eligible for the tax credit.

Mounting Equipment: Expenses related to mounting the solar panels, such as racks or frames to secure them to the roof or ground, are also eligible for the tax credit.

Wiring and Electrical Work: The cost of wiring the solar panels to the electrical system of the property, as well as any necessary electrical work to integrate the solar energy system, is considered eligible for the tax credit.

Energy Storage: Energy storage devices, such as batteries, are also included in the expenses considered for the federal solar tax credit. These devices store excess electricity generated by solar panels for later use, typically during periods when solar energy production is low or when electricity demand is high.

Permits and Inspections: Expenses incurred for obtaining permits and undergoing inspections required for the installation of the solar energy system are also eligible for the tax credit.

How to claim federal solar tax credit?

Ensure Eligibility: Confirm that you meet all eligibility criteria for the tax credit, including having installed a qualifying solar energy system, owning the property where the system is installed, and using the system for a qualified purpose.

Keep Records: Maintain thorough records of all expenses related to the purchase and installation of the solar energy system. This includes invoices, receipts, contracts, and any documentation related to permits and inspections.

Complete IRS Form 5695: Fill out IRS Form 5695, “Residential Energy Credits,” which is used to claim various residential energy credits, including the federal solar tax credit. Provide accurate information about the cost of the solar energy system and any other qualifying expenses. Click here to get the link of the 5695 form.

Calculate the Credit: Calculate the amount of the tax credit by applying the appropriate percentage to the total qualified expenditures. The percentage may vary depending on the year of installation, so refer to the relevant tax year’s instructions for the most up-to-date information.

Let’s say your total qualified expenditures amount to $25,000. If the tax credit is 30% then, Tax Credit = Total Qualified Expenditures × Applicable Percentage = $25,000 × 0.26 = $6,500.

Include Form 5695 with Tax Return: Attach Form 5695 to your annual federal income tax return (e.g., Form 1040) when filing your taxes. Make sure to submit all required documentation and any other supporting forms or schedules as instructed by the IRS.

Claim Any Excess Credit: If the tax credit exceeds your tax liability for the year, you may be able to carry forward the excess credit to future years. Follow IRS guidelines for reporting any unused portion of the credit on subsequent tax returns.

Consult a Tax Professional: Consider consulting with a tax professional or accountant for personalized advice and assistance with claiming the federal solar tax credit. They can help ensure accuracy, compliance with tax laws, and maximize your tax benefits.

Conclusions

The federal solar tax credit serves as a vital incentive for individuals and businesses to invest in solar energy systems, promoting sustainability and reducing reliance on fossil fuels.

By providing financial benefits for qualified expenditures associated with solar installations, the tax credit encourages the adoption of renewable energy technologies while offering taxpayers opportunities to reduce their tax liabilities.

As renewable energy continues to play a crucial role in addressing environmental challenges, the federal solar tax credit remains an essential tool in advancing the transition to a cleaner and more sustainable energy future.